34+ What Is A Passive Entity Chapter 171

1 the entity is a general or limited partnership or a trust other than a business trust. Input box 35 - Taxpayer number.

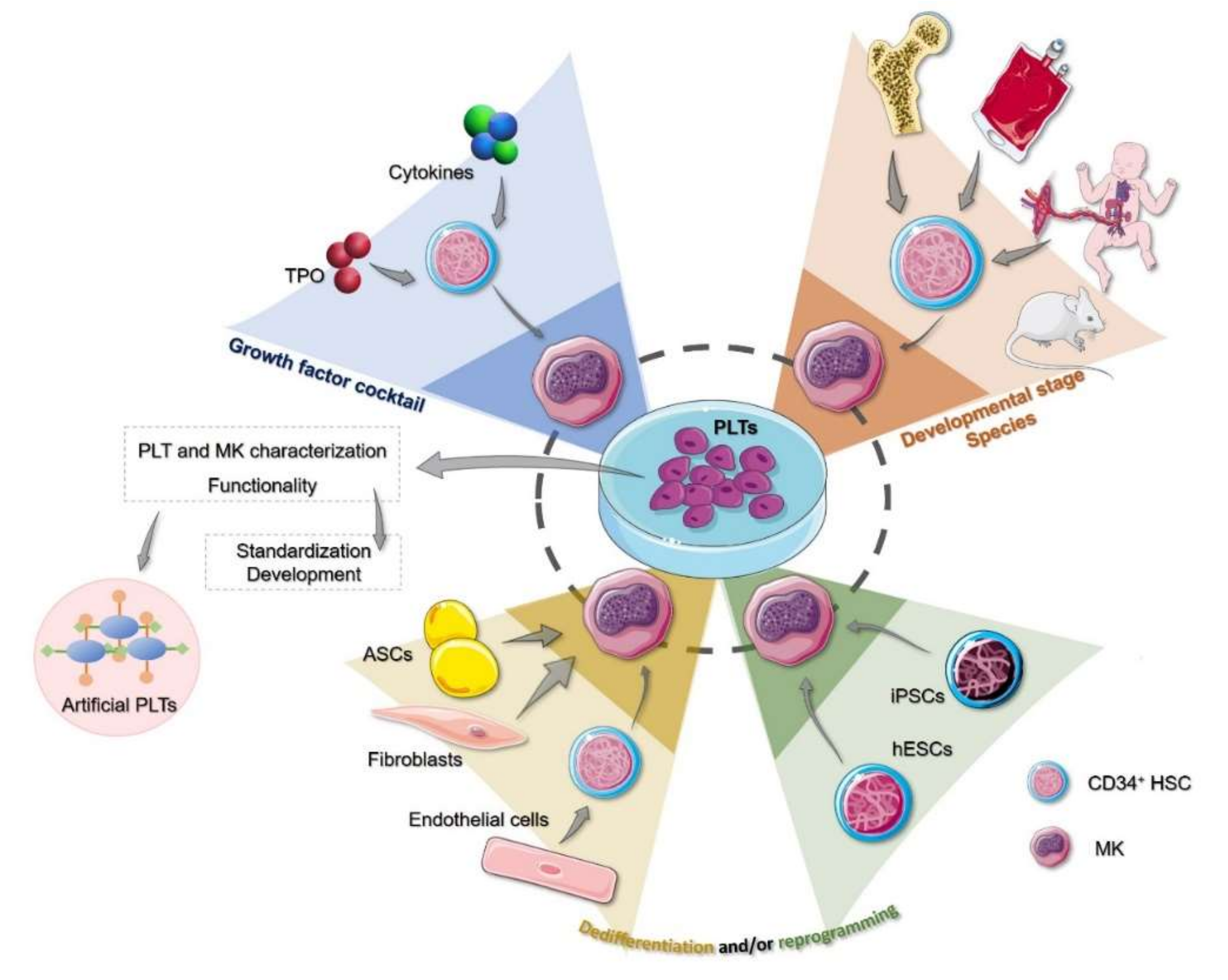

Medicina Free Full Text On The Quest For In Vitro Platelet Production By Re Tailoring The Concepts Of Megakaryocyte Differentiation

Input box 50 - X if a passive entity as defined in Chapter 171 of the Texas Tax Code input X.

. 2 during the period on which margin is. Summary a An entity is a passive entity only if. The entity used the.

1 the entity is a general or limited partnership or a trust other than a business trust. The entity has zero. If a passive entity receives notification in writing from the comptroller asking if the entity is taxable the entity must reply to the comptroller within 30 days of the notice.

This is the amount for 2016 and. Input box 34 - Taxpayer name. Current as of April 14 2021 Updated by FindLaw Staff.

Rental income is not passive per the Texas Tax Code. The Texas Franchise Tax Chapter 171 of the Texas Tax Code is a tax on gross receipts and these gross receipts must exceed 1110000. Definition of Taxable Entity.

1710003 Definition of Passive Entity a An entity is a passive entity only if. Definition of Passive Entity a An entity is a passive entity only if. Definition of Passive Entity a An entity is a passive entity only if.

The entity has zero Texas Gross Receipts. A An entity is a passive entity only if. 3 a passive entity as defined by Section.

1the entity is a general or limited partnership or a trust other than a business trust2during the. The entity is passive as defined in Chapter 171 of the Texas Tax Code. Texas Tax Code TAX 1710003.

Tax Code 1710003. 2 during the period. Texas Tax Code - TAX 1710002.

Texas Tax Code TTC 1710003b. The entity is a passive entity as defined in Chapter 171 of the Texas Tax Code TX Tax Code 1710003. DEFINITION OF PASSIVE ENTITY.

1 the entity is a general or limited partnership or a trust other than a business trust. A An entity is a passive entity only if. 1 the entity is a general or limited partnership or a trust other than a business.

Entities that became subject to the tax during the previous calendar year and have a federal accounting year end date that is prior to the date the entity became subject to the tax will use. However if an entity meets the criteria as a passive entity the entity may qualify as passive even if the entity has some rental income. The liability of which is not limited under a statute of this state or another state including by registration as a limited liability partnership.

1 the entity is a general or limited partnership or a trust other than a business trust. 2 during the period on which margin is based the entitys federal. The entity has 300000 or less in Total Revenue.

1 the entity is a general or limited partnership or a trust other than a business. Section 1710003 - Definition Of Passive EntityaAn entity is a passive entity only if. Passive Entity a Person that conducts no business activity other than the ownership of Stock and has no Indebtedness other than Guarantee Obligations relating to its Subsidiaries.

Definition of Passive Entity Tex. 1 the entity is a general or limited partnership or a trust other than a business trust. A An entity is a passive entity only if.

121010 Iran Gulf Military Balance

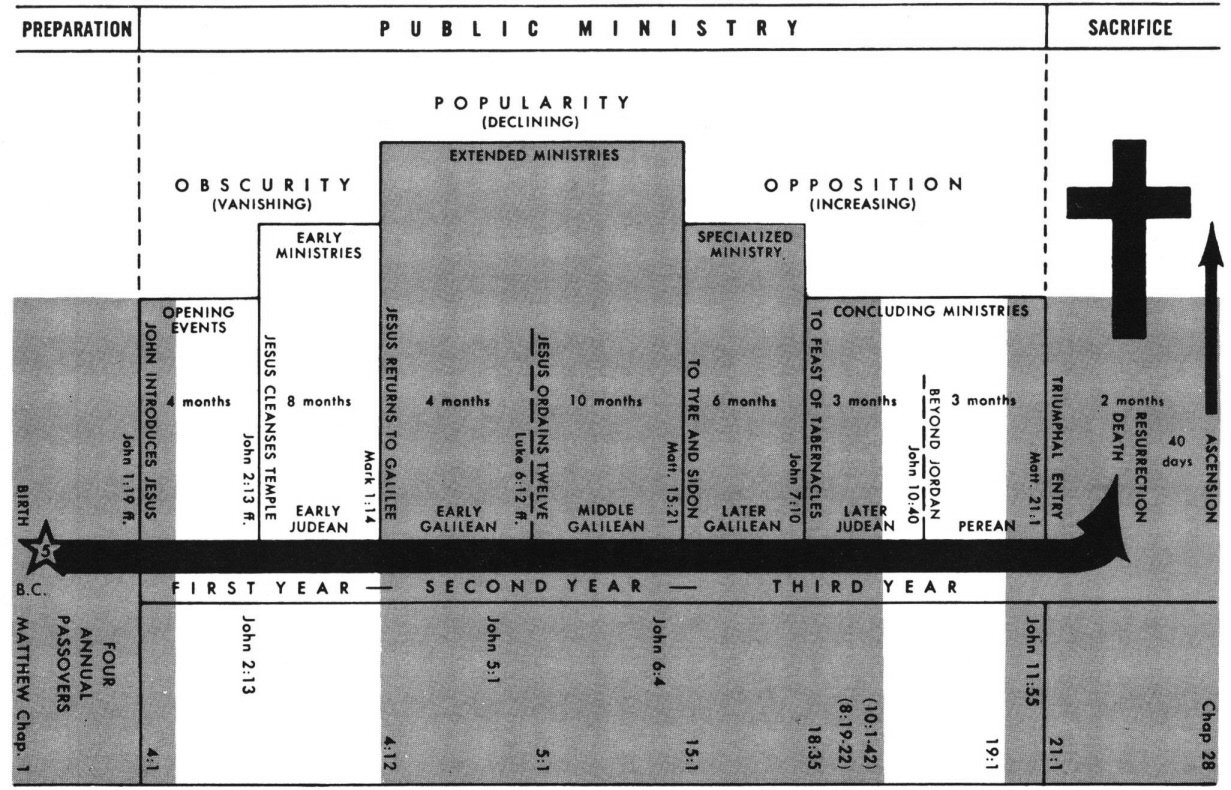

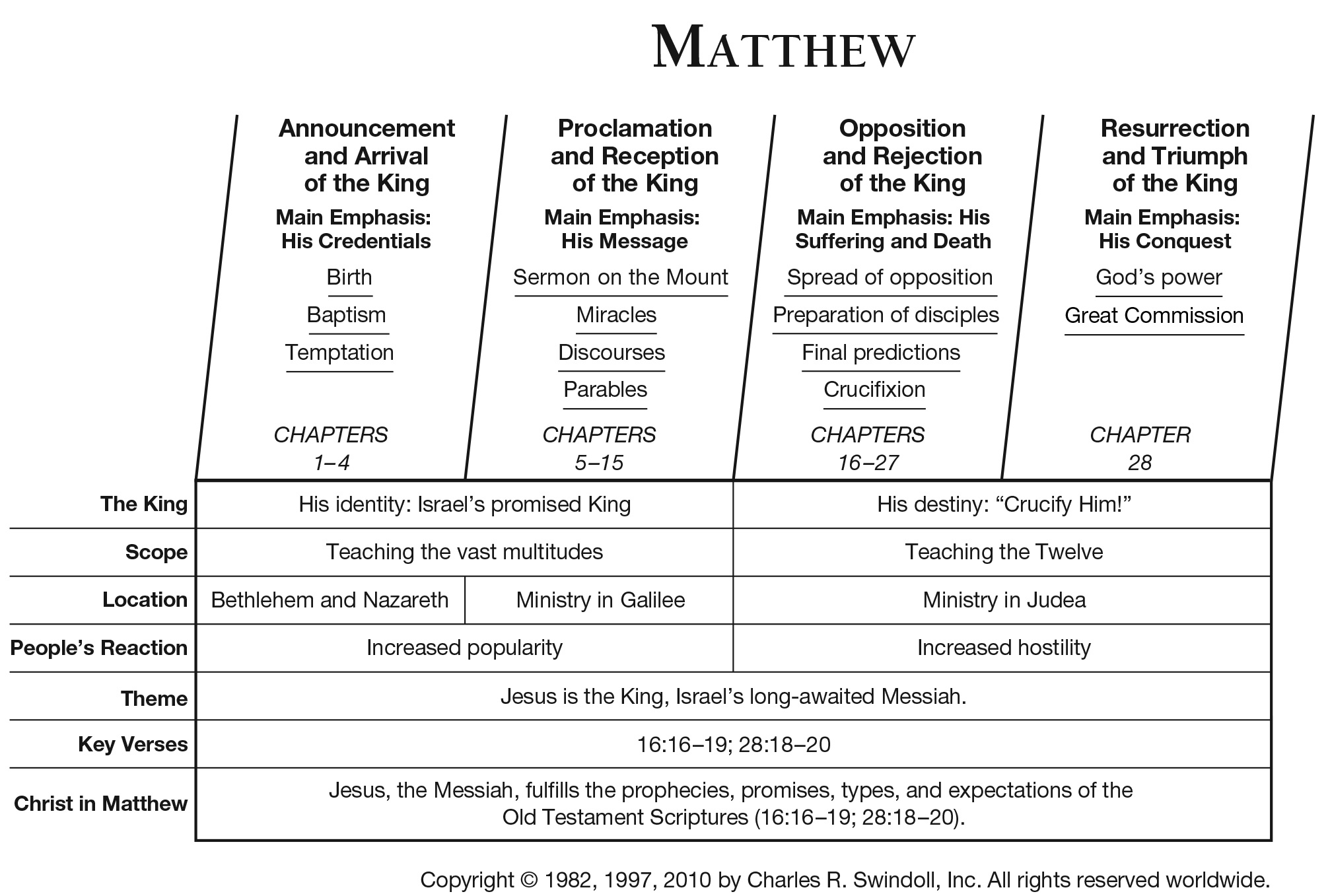

Matthew 13 Commentary Precept Austin

Matthew 13 Commentary Precept Austin

A Good Catholic Is Hard To Find Roamin Catholic Sensibility In Toole Mccarthy And Delillo

Proceedings Of Reanimation 2022 The French Intensive Care Society International Congress Scienceopen

Banking Notes With Digests From Kriz P Cha Mendoza Pdf Foreclosure Loans

Pdf Tinnitus And Attention Training Kj Wise Academia Edu

Photo And Redox Driven Artificial Molecular Motors Chemical Reviews

Passive Entities Under Texas Tax Law Redw Advisors Cpas

Pdf The First Humans Rafaela Macedo Academia Edu

Pdf Low Income Students Human Development And Higher Education In South Africa

Download Mats Amp Laspec Tdr Facility For Antiproton And Ion

Pdf Subculture And Small Group Identity In Iron Age And Roman Baldock Keith Fitzpatrick Matthews Academia Edu

Does The Texas Franchise Tax Affect The Type Of Entity You Choose Lexology

Temperate Rocky Reef Fishes Sciencedirect

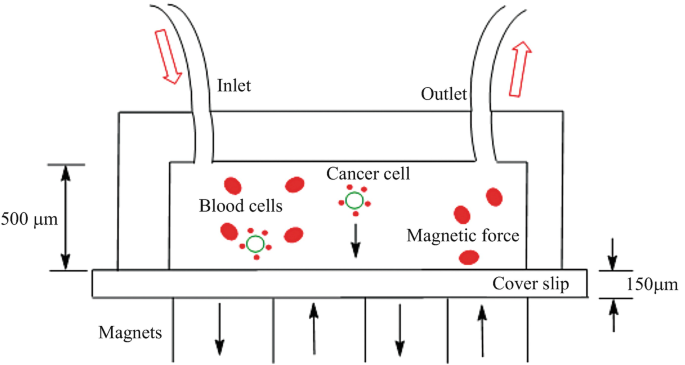

Isolation And Purification Of Various Mammalian Cells Single Cell Isolation Springerlink

Photo And Redox Driven Artificial Molecular Motors Chemical Reviews